What’s the right tariff code for clothes? If you’re exporting clothing from (or importing to) Ireland, which HS codes do you need to use, and why?

Confusion over the HS code system is one of the most common complaints of Irish clothing exporters. There are dozens of different tariff codes for clothing, depending on the type of clothing you’re selling and what those clothes are made from. The costs of getting your HS category codes wrong can be substantial, so it’s absolutely vital that you get it right from day one!

In this guide, we’ll reveal how HS codes impact the Irish clothing industry. We’ll explain why there are so many tariff codes for fashion and apparel, and what these complex tariff codes are actually used for. We’ll also give you some tips on how to protect yourself in the event of a coding mistake.

Why are there so many tariff codes for clothing?

Every type of product that you could possibly think of has its own category code, or tariff code, under the World Customs Organisation’s “Harmonized Commodity Description and Coding System” (HS codes, for short). If you haven’t heard of tariff codes before, our beginner’s guide to the HS coding system explains the basics.

If you’re exporting antiques or machinery, there’s a good chance that all of the HS codes you’ll ever need will be grouped together in one section. For clothing, there isn’t one single section in the HS nomenclature. Tariff codes for apparel are all over the place.

What are the Tariff Codes for Clothing?

The HS tariff system is divided into sections and chapters, all of which are grouped roughly by raw materials. This is a problem for the apparel industry, because clothes can be made from a huge range of raw materials, from suede to denim and complex engineered fabrics like nylon.

The HS tariff system is divided into sections and chapters, all of which are grouped roughly by raw materials. This is a problem for the apparel industry, because clothes can be made from a huge range of raw materials, from suede to denim and complex engineered fabrics like nylon.

For instance, Section VIII of the HS code book covers ‘Raw hides and Leathers’, while ‘Textiles and Textile Articles’ fall under Section XI. If you’re selling hats or footwear, then your goods will fall under Section XII.

Every section is divided into chapters, then each chapter is subdivided into more specific subheadings. A womens wool skirt, for instance, could have an HS code of 6204510019, but if a hand-made leather belt accompanies that skirt, you’ll also need to know the HS code for ‘handmade leather belts’ (4203300010).

There are hundreds of different tariffs, and you need to be 100% sure that the HS code you have chosen is the right one. Even the smallest errors can cost time and money.

The importance of getting your tariff code right

Tariff codes are the foundation of the modern customs environment. HS codes tell countries which customs duties and VAT to apply to clothes, as well as what security checks to conduct on incoming cargo. HS codes also help governments to monitor consumer trends and plan for international trade. When tariff codes are inputted correctly, state bodies like the Central Statistics Office (CSO.ie) are able to collect data from Irish ports and get an accurate picture of just how many t-shirts, trousers, shoes and so on are coming in and out of the country at any given moment.

The HS coding system only works when the data that exporters and importers provide is accurate. This could be why the penalties for HS code mistakes can seem so severe.

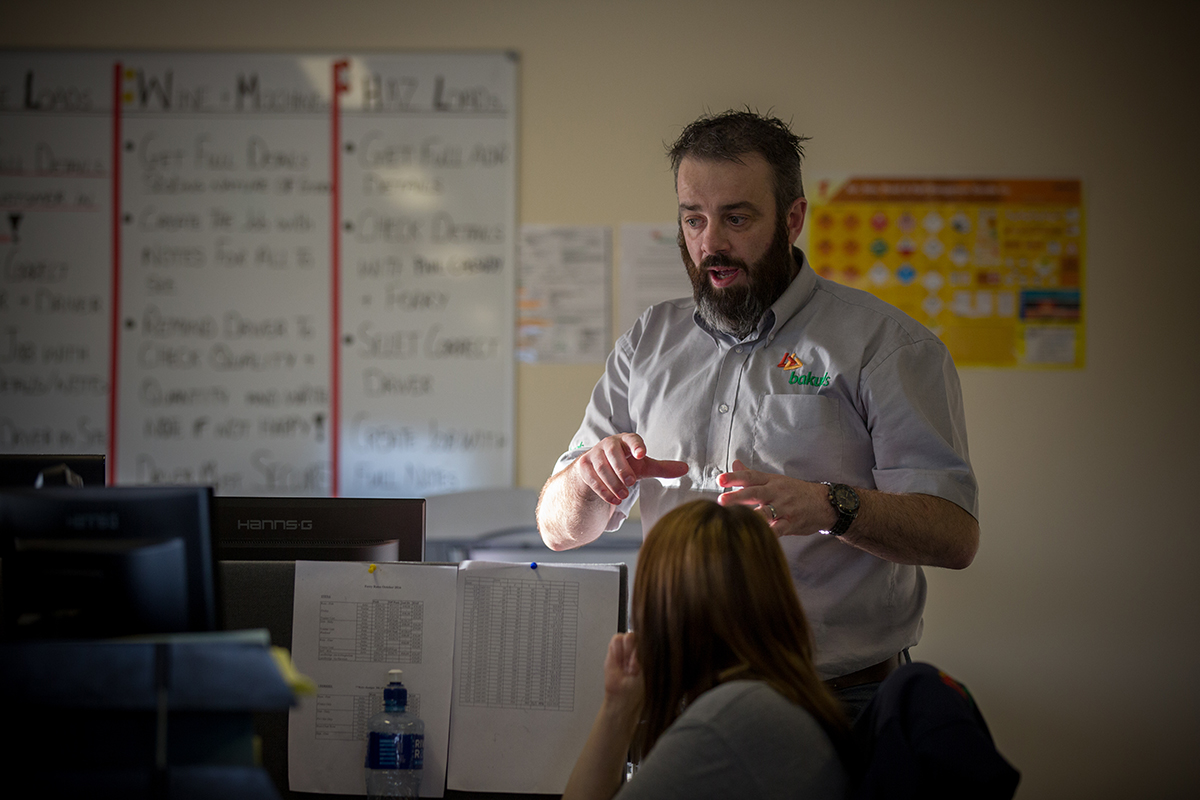

If you get even one digit wrong in the HS code of just one of the products you’re shipping out to an overseas buyer, your whole shipment could be delayed at customs. You and your buyer could pay too much in tariffs and VAT, and/or face civil and even criminal penalties. Genuine mistakes do happen of course, but it can be very difficult to ‘undo’ a customs declaration after it has been accepted by the authorities. In our experience, the best thing to do is to seek outside help from a third-party customs expert. Baku GLS can help – just get in touch and we’ll talk you through our customs support services.

Protect your business against HS code mistakes

You can search the TARIC database and try to figure out the tariff codes yourself. This is a great way to get started, but if you need to make a formal customs declaration, then it’s well worth seeking expert help. We have a customs team here at Baku GLS, but we’re by no means the only option — any third-party customs clearance expert worth their salt should be able to check and confirm HS codes for you.

Another route to go down is to ask Customs directly. Irish Tax and Customs have a ‘Classification Unit’ whose staff can issue non-legally-binding advice. It can be hard to get through to them on the phone, but they do accept email enquiries. Take a look at the revenue.ie website for more help.

The UK Government’s website has created a lot of helpful guides on customs since Brexit, and they use the exact same customs coding system. The Gov.uk guide to classifying textile apparel gives a solid overview of the most common types of clothing.

You can also apply for Binding Tariff Information. With Binding Tariff Information (BTI), you get a legally-binding certificate, normally valid for 3 years, that confirms the HS code of your product. These BTI documents offer the highest level of protection against HS classification mistakes. You need to check them periodically (if the coding system changes or if there are changes in EU law, your BTI could become invalid), but they’re well worth the investment if you’re uncomfortable with the HS coding system. You can learn more about BTI on the Revenue.ie website.

We hope this explains the basics of HS codes for clothing! If you’re an apparel wholesaler, fashion designer or textiles manufacturer and you need expert customs clearance advice, talk to Baku GLS. We have more than twenty years of experience in the industry, and we have an in-house team of customs professionals ready to share their expertise. Just give us a call on 053 9161786 to learn more!